What happens if you’ve been saving and saving for retirement, and something happens in the market? What if that something causes you to lose 50% of what you have saved? Well, if you’re closing in on retirement, maybe 5 years away, what do you do?

According to Jim Ward, director of Advisory Services at Retirement Planners of America (RPOA), you should have an honest conversation with yourself about how ready you are to retire. Can you put it off for a little while longer? According to Ward, that’s also a conversation you should have with your advisor.

“It’s not a comfortable conversation, but I believe any advisor worth their salt will have the uncomfortable conversation with you,” says Ward. “Your advisor could have some suggestions to help you recover that lost money before retirement.”

Ward recommends looking at when you start taking Social Security is one place to take a hard look. Do you need to take it as soon as allowed? Or can you hold off and get the most money out of Social Security.?

RPOA retirement planner, Jordan Roach, explains how people can look at making changes to their investment fund allocations or possibly utilizing Roth accounts that allow assets to grow tax free to help recoup investment losses instead of having to work longer to earn additional income to be able to retire.

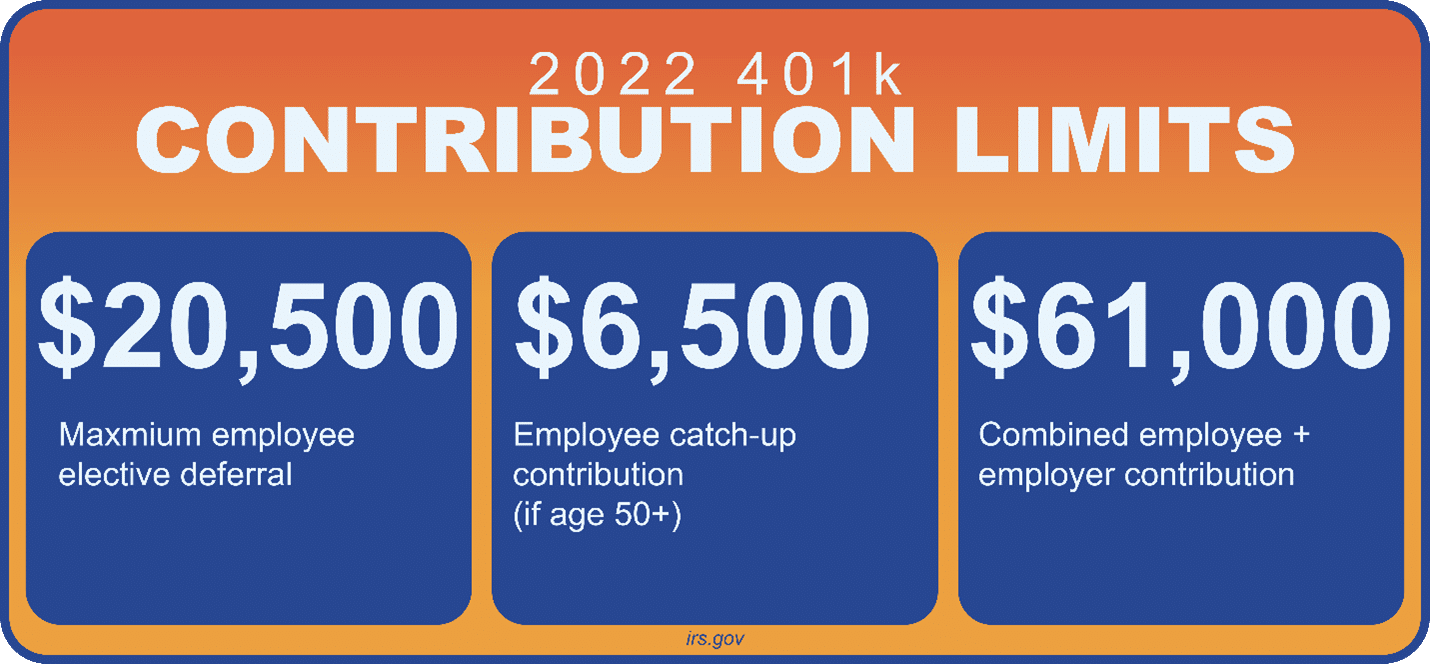

“Roth accounts can be a good way to rebuild some of the wealth you lost without having to re-earn those wages,” Roach says. “This only works when the market cooperates, and I always recommend discussing this type of strategy with a financial advisor.” Roach also recommends taking advantage of employer matches for 401(k) and/or Roth 401(k) contributions. Also, at age 50, you qualify for “catch up contributions” in both qualified and non-qualified retirement plans. In 2022, the catch-up contribution limit is $6,500 for each type of plan.

Roach believes ultimately updating someone’s retirement plan is ideal, because overall, some people can weather some losses. RPOA’s Invest and Protect Strategy is designed to take advantage of the market’s unlimited upside with a tolerable downside.

If you’d like to learn more about RPOA’s Invest and Protect Strategy, sign up to meet with a retirement planner here.